Reviewing the Performance of the Best Futures Trading Brokers

Reviewing the Performance of the Best Futures Trading Brokers

Blog Article

Futures trading is an essential the main world wide financial landscape, providing opportunities for both speculation and hedging. Whether you're a starter or a skilled trader, understanding the fundamentals of Futures trading review is crucial for navigating that dynamic market. That evaluation gives an extensive look at futures trading, showing important factors for equally novices and veteran professionals.

What's Futures Trading?

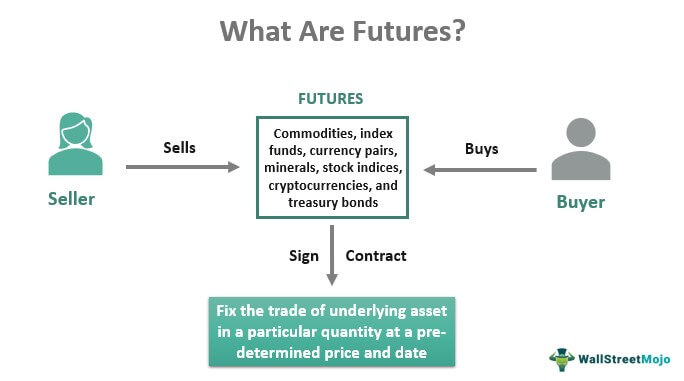

Futures trading involves getting and offering contracts that obligate the customer to purchase, or the vendor to market, a resource at a predetermined price and day in the future. These agreements can be centered on a number of main resources such as for instance commodities, indices, or currencies. Futures trading is commonly utilized by traders to hedge risks or even to suppose on price movements.

How Futures Trading Works

In a typical futures agreement, two events agree with the buying price of a property for a particular potential date. For example, a raw gas futures contract might collection a price of $50 per barrel for delivery in three months. If the price tag on crude oil rises over $50 at the time of distribution, the buyer profits. Conversely, if the price falls below $50, owner benefits.

Futures contracts may be exchanged on specific exchanges, providing a transparent and governed environment. Market individuals can often take long roles (buying) or small roles (selling), relying on the market outlook.

Benefits of Futures Trading

Among the principal features of futures trading is leverage. Traders may get a grip on a sizable position with a relatively little bit of capital. That power may magnify profits but in addition increase the risk of losses. Futures trading also presents freedom, as contracts can be traded on various assets, such as for example metals, agriculture, or financial products.

For hedgers, futures give ways to secure in charges for potential purchases or sales, helping to manage value volatility. This feature is particularly important for businesses that rely on natural resources or commodities inside their manufacturing processes.

Considerations for Newcomers and Specialists

While futures trading presents fascinating options, additionally it carries substantial risk. For novices, it's crucial to comprehend the aspects of industry and the different types of agreements before committing capital. Starting with small positions and paper trading will help build knowledge without exposing oneself to big losses.

For skilled traders, advanced strategies such as for example distribute trading or using futures in conjunction with other instruments can offer additional methods to benefit from market movements. But, actually experienced experts must remain cautious and alert to the risks involved.

:max_bytes(150000):strip_icc()/Futures_final-1113dde1485f4dc9ab4a8c0efc427700.png)

Realization

Futures trading is an exciting yet complicated economic activity that provides options for equally speculation and risk management. By understanding the basic principles, applying correct strategies, and handling chance efficiently, traders can navigate the futures market successfully. If you are only beginning or have decades of experience, remaining knowledgeable and disciplined can help you succeed in this fast-paced environment. Report this page